nc estimated tax payment calculator

As required by law with its main office located at 1415 Vantage Park Drive Suite 700 Charlotte NC 28203. Tax Preparer Penalties apply to tax return preparers who engage in misconduct.

Property Tax Calculator Smartasset

Share per value refers to the stated minimum value and generally doesnt correspond to the actual share value.

. Americas 1 tax preparation provider. 30000 8 2400. Taxes and insurance are not included in the estimated monthly payment amount.

Form NC-40 Instructions - Estimated Tax Instructions. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Our FREE Cost Segregation Savings Calculator estimates your federal income tax savings and provides.

Our home loan equity calculator will help you determine if a home equity loan or line of credit is right for you by the amount of equity in your home. Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Americas 1 tax preparation provider. Finally if you filed your return more than 60 days late the minimum penalty for failure to file is 135 or 100 of the tax you owe whichever is smaller.

You must file estimated individual income tax if you are self employed or do not pay sufficient tax withholding. You didnt make a required payment because of a casualty event disaster or other unusual circumstance and it would be inequitable to impose the penalty or. HHS Benefit and Payment Parameters for 2014 and Medical Loss Ratio.

Tool requires no monthly subscription. Self-Employed defined as a return with a Schedule CC-EZ tax form. Income Tax Calculator.

The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City Missouri. Add this to the cost of the car. The mortgage section assumes a 20 down payment on the home value.

In reality the value of a share is based on its fair market value or the amount a buyer is willing to pay. 1 online tax filing solution for self-employed. Click image to enlarge.

North Carolina moved to a flat income tax beginning with tax year 2014. Some states dont allow a deduction of sales tax on trade-ins. After applying any payments and credits made on or before the original due date of your tax return for each month or part of a month unpaid.

Income Taxes By State. For tax year 2021 all taxpayers pay a flat rate of 525. Content Writer 247 Our private AI.

You can use our free North Carolina income tax calculator to get a good estimate of what your tax liability will be come April. Form 502D is meant to be filed on a quarterly basis. Additional tax withheld dependent on the state.

It now takes 3551 of the median household income to make a principal and interest payment on the average home. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Please use the calculator to calculate monthly payment and APR for different loan options. This varies across states and can range from 0 to more than 8. This can range from 24 to 37 of your winnings.

The calculator provides the estimated home equity loan or home equity line. Estimated allocations to 5 7 15 and real property Tax deductions and additional cash flow each year. In practice however a 20 down payment is too hefty for most borrowers.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. The maximum penalty is 25. Credit reporting agency Experian reported that the average down payment for homebuyers in 2018 was 13.

Future rates are subject to change so the rates for months 61-final month of loan term are estimated by adding the margin to the current index rateFuture rates and payments determined based on adding a margin of 250 to the future index 5-Year. The law allows the IRS to waive the penalty if. From the original due date of your tax return.

Process for a State to Submit a Request for Adjustment to the Medical Loss Ratio Standard of PHS Act Section 2718 PDF April 26 2011. Use Form 2210 Underpayment of Estimated Tax by Individuals Estates and Trusts to see if you owe a penalty for underpaying your estimated tax. Income Tax Returns No Payment North.

Estimated income tax payments are made to pay taxes on income generated in a given tax year - now 2022 - that is not subject to periodic tax withholding payments as wages are via the W-4 formGenerally if you are an employee whose only income is from a W-2 with taxes withheld you will not have to worry about making estimated income tax. Engine as all of the big players - But without the insane monthly fees and word limits. Calculate the amount of state sales tax and add it to the estimated purchase price.

If this is the price of your house you must prepare a down payment of 66120. Using the values from the example above if the new car was purchased in a state without a sales tax reduction for trade-ins the sales tax would be. Your actual monthly payment will be greater.

100 of the amount due. The table above used 600 as a benchmark for monthly debt payments based on average 400 car payment and 200 in student loan or credit payments. HHS Benefit and Payment Parameters for 2014.

Registered agents are responsible for receiving all legal and tax documentation on behalf of the corporation. March 11 2013 CMS-9964-F. Meanwhile those who bought houses for the first time only made a 7 down payment.

If your tax return shows a balance due of 540 or less the penalty is either. Over 500000 Words Free. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

Dishonored Checks applies when your bank doesnt honor your check or other form of payment. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

As you can see the monthly penalty for. Mortgage rates valid as of 27 Sep 2022 1008 am. December 17 2010 OCIIO Technical Guidance.

The taxes you will have to pay in order to receive your. 3 Cash out is defined as any funds that exceed the balances owed on the first andor second. 2 100 financing up to a maximum loan of 500000.

Also find out how much your state charges for tax and title fees. Mortgage interest rates top 6 for first time since 2008. Underpayment of Estimated Tax by Corporations applies when you dont pay estimated tax accurately or on time for a corporation.

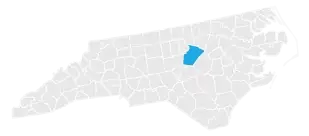

That rate applies to taxable income which is income minus all qualifying deductions and exemptions as well as any contributions to a retirement plan like a 401k or an IRA. 1 online tax filing solution for self-employed. You must pay tax on the total cost.

Income tax withheld by the US government including income from lottery prize money. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Payroll Tax Calculator For Employers Gusto

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

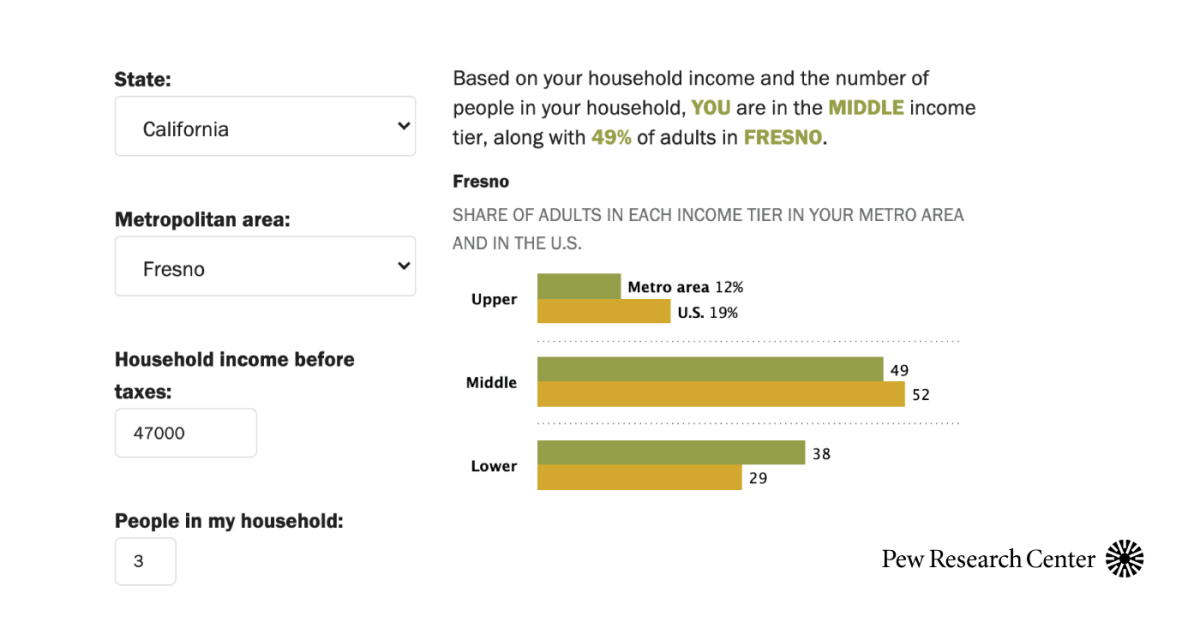

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

The Last Chance For Some Tax Filers To Avoid Late Penalties Is June 15

Wake County Nc Property Tax Calculator Smartasset

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Quarterly Tax Calculator Calculate Estimated Taxes

The Ultimate Guide To North Carolina Property Taxes

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Nanny Tax Payroll Calculator Gtm Payroll Services

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Dmv Fees By State Usa Manual Car Registration Calculator

11104 Eta Screen Estimated Payments For Next Year S Changed Tax Situation

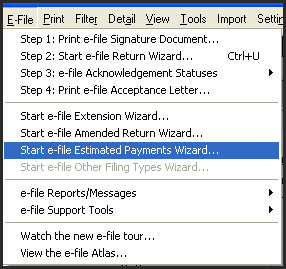

Using The E File Estimated Payment Wizard In Lacerte

State Returns Estimated Tax Vouchers Direct Debit

Mortgage Calculator Free House Payment Estimate Zillow

North Carolina Income Tax Calculator Smartasset

North Carolina Title Insurance Calculator With 2022 Rates Elko